The year was 1903. Benjamin Graham’s father Isaac had recently died at age thirty-five. Isaac’s once-thriving New York china shop was shuttered. Ben’s mother Dorothy had three sons to raise—eight-year-old Ben, nine-year-old Victor, and ten-year-old Leon—and no means of supporting them. She had grown up in a prosperous merchant family in Warsaw. To my knowledge, she had never worked outside the home. How did Dorothy and the boys get by? A partial answer: with a little help from Ben.

For big help—food on the table, a roof over their heads—Dorothy relied on her elder brother, Maurice. (Other siblings likely helped.) Ben Graham relates in his Memoirs that between 1903 and 1906, the three years that followed his father’s death, Dorothy and the three boys lived with Maurice Gesundheit and his family of four (becoming five, with the birth of a baby girl) at 244 West 116th Street in upper Manhattan.

“We were a very crowded pair of families, living in a nine-room flat with a single bathroom.” Benjamin Graham

The out-of-print autobiography—Benjamin Graham: The Memoirs of the Dean of Wall Street—serves as my prime source for this post. Of himself and his brothers, Ben writes:

“…we all tried to earn small sums in whatever employment we could find or invent.”

Perhaps Ben was following his older brothers’ example when, at the age of nine, Ben signed up to sell The Saturday Evening Post. Small of stature, with a head of black curls, he stood near the exit to the Elevated line exit at 116th Street and 8th Avenue and called out to passersby, “Get your Saturday Evening Post, five cents a copy.” He paid three cents each for thirty copies, and earned two cents profit per copy. If he sold all thirty papers, he would bring sixty cents home to his mother. Ben does not reveal how long this went on, nor whether his earnings constituted a significant or meager contribution to his mother’s shoestring budget.

Shortly after Ben started high school (at the young age of twelve, because he’d skipped several grades), Dorothy decided to move her family out of her brother’s apartment. She wanted to try her hand at running a boardinghouse in a rented brownstone on Harlem’s 129th Street. He recalled sharing a basement room with his mother, no doubt because paying guests occupied all the upstairs rooms. However, the smell of the livery stable across the street wafted through the brownstone’s windows. As the summer grew hot, the stench grew unbearable and the boardinghouse could not keep its guests.

Dorothy moved her operation to a less “fragrant” location near Barnard College, where twelve-year-old Ben became infatuated with one of the boarders, a bright and vivacious eighteen-year-old named Constance. She gave Ben French lessons and read French poems with him, inspiring him to translate a poem by Victor Hugo into English. He credited her with sparking his lifelong passion for translating poetry. Unfortunately, Dorothy’s second boardinghouse also proved unsuccessful. Within two years, the business closed and she was forced to sell off the family’s possessions at auction. A crowd formed outside the house, and Dorothy gave each of her sons a job. Clever at math, Ben added up the meagre proceeds. He remembered his mother’s gloomy expression at the rock-bottom sale prices—and her smile when the upright piano sold for a glorious $150.

Ben’s older cousin Louis Grossbaum, whom he admired for his proficiency in Latin and Greek, helped him to sell baseball cards at the Polo Grounds. They made two cents on the sale of each pair of cards. Ben was lucky to make twenty cents on a weekday, or as much as a dollar during a weekend doubleheader. While he details the sums he earns, he does not enlighten readers regarding how much his earnings helped to mitigate the family expenses.

“In those days nearly every family wanted to appear richer than it was; for us it seemed even more essential not to appear as poor as we actually were.” Benjamin Graham

During this same period, Ben was sufficiently talented in mathematics to tutor a boy who was a grade ahead of him, and earned fifty cents for giving the boy three lessons per week. (Later in his teens, he tutored the sons of General Leonard Wood and other officers stationed at Governors Island. He continued to tutor on Governors Island throughout his college and early Wall Street years, taking the ferry four times a week.) Ben found ways to contribute small sums to the family budget while proving himself an excellent student. Throughout his boyhood, he read library books—from Dickens to Horatio Alger—with avid interest and impressed his teachers with his quick mind. Odysseus’s adventures in The Odyssey captured his imagination.

After-school jobs were no doubt a source of pride for Ben. Perhaps, though he does not say so, his mother expressed some appreciation when he brought her his wages. Certainly, earning money helped him prove his worth—to her, his brothers, and himself. Competing with his brothers for his mother’s approval became his lifeblood. The youngest and smallest, he yearned to outshine the older boys.

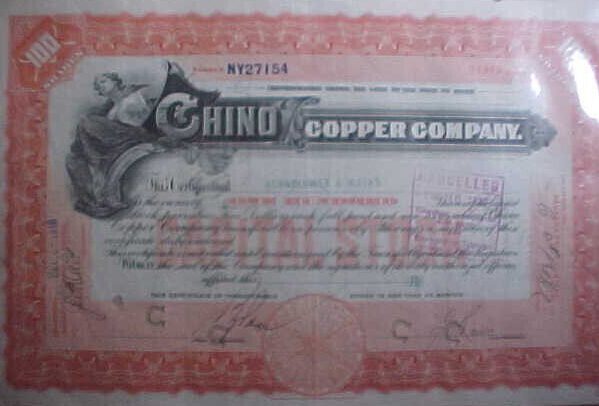

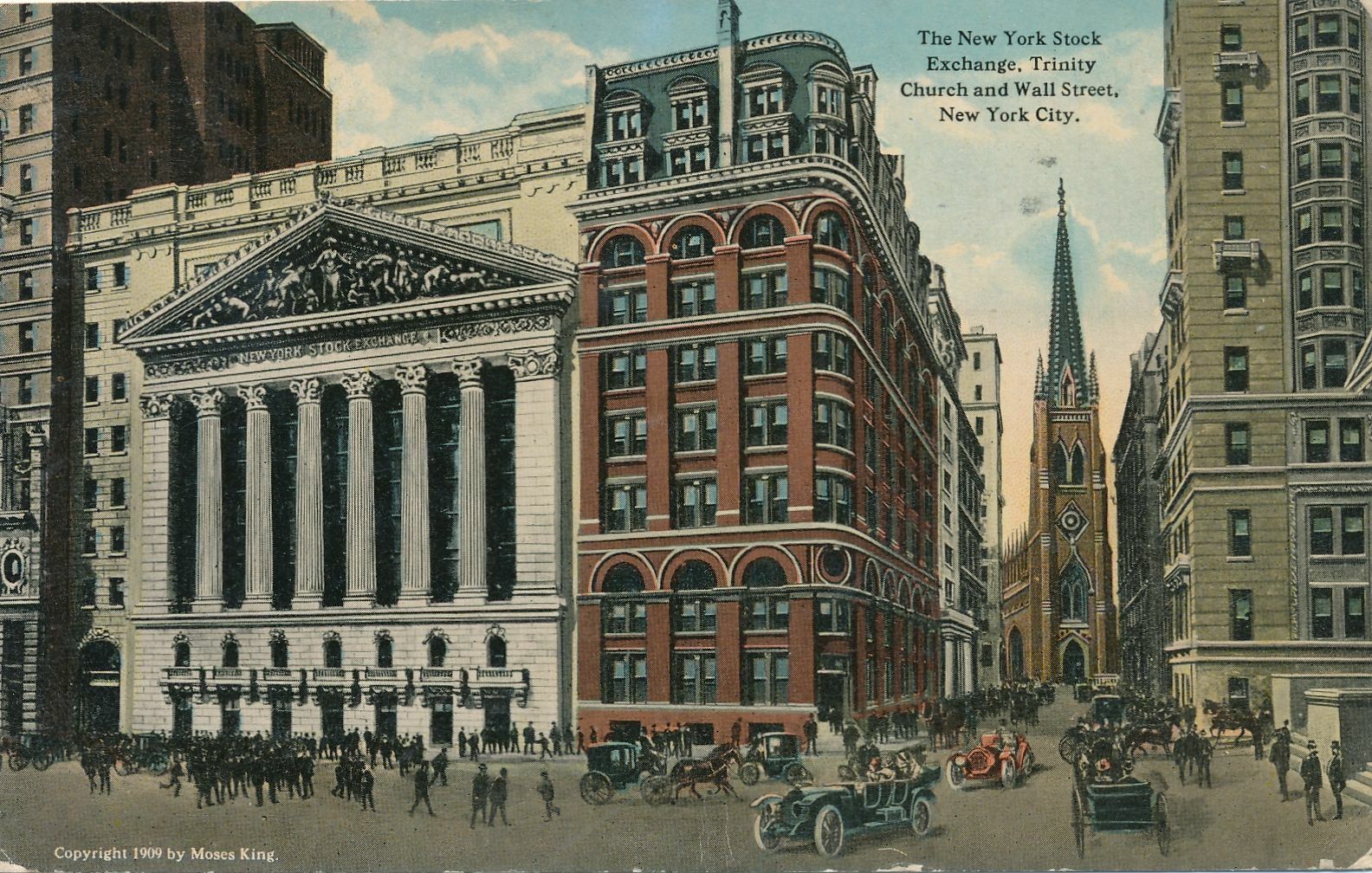

Except for her failed boardinghouses, Dorothy did not seek employment, but she did attempt to make a profit by investing her savings in U.S. Steel. She opened a small account with a broker friend who was a member of the Consolidated Stock Exchange, which allowed investors to trade in units of ten shares, as compared to a minimum of 100 shares on the New York Stock Exchange.

“Thus there was a time when as a small boy I would open our paper at the financial page each day to see what U.S. Steel had done. Ignorant as I was of finance, I knew enough to be glad when the price advanced and sorry when it was down.” Benjamin Graham

Unbeknownst to Dorothy and Ben, their broker “friend” and his son were running a crooked bucket shop. A common scam in those days, a bucket shop put the client’s money in the shop owner’s own “bucket” while pretending to purchase stock in the client’s name. Bucket shops relied on inevitable market downturns to wipe out their customers’ margin accounts, allowing the shop operators to bilk clients of their entire investments. When the price of U.S. Steel fell precipitously, the “friend” kept Dorothy’s life savings and told her that her margin account had been wiped out in the Panic of 1907. According to Ben, this racket continued unabated until the late 1920s, when a few of the white-collar thieves, including the “friend’s” son, were sent to jail.

After her investment and boardinghouse debacles, Dorothy had no choice but to move her family back in with Dorothy’s brother Maurice, who now lived in far-off Borough Park, Brooklyn. Maurice’s small house barely accommodated the two families. I can only imagine how hard it must have been for Dorothy to ask her brother, once again, to take them under his roof. Ben’s uncle Maurice must have faced his own difficulties in providing for his sister and three nephews. It’s impressive that, despite their clashes and heated quarrels in their native Polish, Dorothy and Maurice made the arrangement work.

Each morning, Ben took a local streetcar, then an Elevated train across the Brooklyn Bridge and finally a subway to his high school—Townsend Harris Hall—in Amsterdam Heights, Manhattan. (When his family moved to Bath Beach, Ben reluctantly transferred to Boys High School in Brooklyn.) As the Memoirs’ editor Seymour Chapman writes in his introduction, it was at Townsend Harris Hall that:

“Graham met and gloried in the challenge of what was arguably America’s best public education. Today one can only marvel at this excellent free instruction—imagine having one of America’s great philosophers, Morris Rafael Cohn, as your high school geometry teacher.”

The trip to school in Manhattan took an hour and a half each way and cost a dollar per week, a sum the family could ill afford.

“But the long hours I spent on trains were far from wasted. I did nearly all my homework while being transported hither and yon. I remember studying my first-year Greek while we rolled slowly over the Brooklyn Bridge…” Benjamin Graham

This diligence left him free to take after-school jobs. At age twelve, Ben found employment delivering goods for a local dairy for $2 per week. He pushed a cart laden with milk bottles to different apartment houses, carried the goods to the cellar, loaded the dumbwaiter and hoisted the heavy wooden box, often as high as the sixth floor. Later, his employer took away the delivery cart and had Ben carry a loaded basket in the hot August sun. In time, he was replaced by a bigger boy. That didn’t stop him from taking another job that required more brawn than brains. At thirteen, he was hired (for a sum unspecified in the Memoirs) to tend a coal furnace. He shoveled out the cinders and performed the “backbreaking job of hauling the barrels of weighty ashes up the cellar steps and then dumping them in a sunken part of the road.”

At the same time, Ben took on two additional jobs: tutoring a neighbor’s boy—the son of renowned labor organizer Joseph Barondess—in mathematics, and transcribing his uncle Maurice’s engineering reports on an Oliver typewriter. He not only devoted some of his brainpower to earning, but he also applied his smarts to thrifty spending. Ben recalls: “we bought only bargains,” such as a five-cent Rocket baseball. He purchased second-hand tennis balls, at three for twenty-five cents. His tennis racket, “a birthday present, a Spalding Favorite, cost a dollar.”

A boyhood of financial hardship made a lifelong impact on the adult man. Benjamin Graham grew up to be a man who chose the subway over taxis, “alleging to myself that [the subway] as quicker… but knowing well that I wanted to save the dollar or so involved.” He also admitted his habit—as a millionaire—of ordering the least expensive entrée on a menu. More profoundly, he never forgot how it felt to lose everything. He knew first-hand the struggle of trying to get by on too little. These experiences kindled his creativity on Wall Street. He invented security analysis and value investing for people like himself and his mother, who wanted their investments to make gains with minimal risk. His essential principle of margin of safety, detailed in The Intelligent Investor, sprang from a boy’s ardent wish to be safe, not sorry, after witnessing his mother’s lost investment in U.S. Steel.

The margin of safety principle guides investors to choose only stocks that they can buy at a price significantly below their intrinsic value. To determine margin of safety, an investor calculates the difference between a stock’s market price and its intrinsic value, as determined by Benjamin Graham’s formula. The larger the margin of safety, the greater the cushion that protects the investor from loss. Countless children, and their parents, shop for bargains, but only this exceptional “small boy”—who bought a baseball and used tennis balls at prices well below their value—grew up to devise a timeless investment principle based on this practice. I’m struck with how elegantly margin of safety distills the lessons of fiscal caution Ben Graham learned in his youth.

Next: The blog dives into Ben Graham’s recognition of his boyhood wounds, as he described them in his own words. In time, Ben Graham gains insight and strength from this wounding that will bring the legendary investor ultimate fulfillment.